fithair.site

Tools

O Interest Rate Credit Cards

Using a low interest credit card can save you big while helping you minimize debt or get rid of it more quickly. See our expert recommendations. A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying off. 0% Intro APR Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus. no interest for a set period of time while you make regular payments. There are also credit cards that promise a 0% interest introductory rate. Zero-interest. Save on interest and travel today! 0% introductory APR1 for the first 12 billing cycles on purchases and balance transfers after account is opened. After that. For a limited time, earn an annual interest rate of % on purchases† and % on cash† for 10 months†. Plus, get: 2% cash back on eligible grocery. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms. 0% APR credit cards ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Simplicity® Card · reviews · 0% for 12 Months ; Capital One Quicksilver Cash. Some credit cards offer an introductory period – often 12 to 18 months – with 0% interest on purchases and, potentially, balance transfers. Using a low interest credit card can save you big while helping you minimize debt or get rid of it more quickly. See our expert recommendations. A 0% credit card is a credit card with a 0% introductory/promotional interest rate available for a set duration. This means you can spread costs by paying off. 0% Intro APR Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus. no interest for a set period of time while you make regular payments. There are also credit cards that promise a 0% interest introductory rate. Zero-interest. Save on interest and travel today! 0% introductory APR1 for the first 12 billing cycles on purchases and balance transfers after account is opened. After that. For a limited time, earn an annual interest rate of % on purchases† and % on cash† for 10 months†. Plus, get: 2% cash back on eligible grocery. Explore low intro rate credit cards ; 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms. 0% APR credit cards ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Simplicity® Card · reviews · 0% for 12 Months ; Capital One Quicksilver Cash. Some credit cards offer an introductory period – often 12 to 18 months – with 0% interest on purchases and, potentially, balance transfers.

Investopedia's database reported an average credit card interest of % as of March How Do You Avoid Paying Interest on a Credit Card? There is only. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. credit card company must apply your entire payment in excess of the minimum payment amount to the deferred interest rate balance first. Last Reviewed: April. Best 0% APR credit cards. Wells Fargo Active Cash® Card: Best for earning cash rewards on purchases. Discover it® Cash Back: Best for first-year. 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. The annual percentage rate (APR) is the cost of borrowing on a credit card. It refers to the yearly interest rate you'll pay if you carry a balance, plus any. If you're interested in receiving 0% APR financing while earning cash back rewards, the The American Express Blue Business Cash™ Card could be one of the best. American Express helps you save with 0% intro APR Credit Cards offers. Compare our cards and different benefits to find the one that works for you best. Know if you're approved for a Card with no impact to your credit score · All Cards · Featured · Travel · Cash Back · Rewards Points · No Annual Fee · 0% Intro APR · No. 0% Intro & Low APR Credit Cards. intro APR no interest balance transfers What Is the Average Credit Card Interest Rate? Other categories. Balance. 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of opening your account. After the intro APR offer. Zero-interest credit cards can be a big help. Here's everything you need to know to make them work for you. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. The purchase rate is the interest rate applied to credit card purchases and only applies to unpaid balances at the end of the billing cycle. Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. 0% APR for the first 18 months (variable % or % APR after the introductory period); Unlimited % cash back on every purchase; No annual fee; No. Instead, the use of APR forces lenders to bake the interest rate and hidden fees together so they can't bamboozle you later. That said, they can still charge. Citi Simplicity® Credit Card · Low intro APRon purchases for 12 months ; Citi® Diamond Preferred® Credit Card · Low intro APRon balance transfers for 21 months. The purpose of a low interest credit card is simple: if you can't pay your balance in full each month, it will reduce the amount of interest you have to pay.

Agri Fintech

WeGro, a leading agri-fintech in Bangladesh has joined the SME Finance Forum as the global membership network's latest member. Agri-Fintech Holdings, Inc.: Company profile, business summary, shareholders, managers, financial ratings, industry, sector and market information | OTC. Agri-fintech is the use of modern financial technology solutions to meet unique needs and resolve any financial challenges in the agricultural field. Discover all the factors affecting Agri-Fintech Holdings's share price. TMNA is currently rated as a Neutral | Stockopedia. An agri-fintech startup that brings together key players in the Indian agriculture value chain to facilitate trade and funding flows. Indonesian PasarMIKRO has developed an innovative agri trade platform and mobile app for agricultural products. Unnati Agri is a leading Agri fintech startup in India that empowers farmers & agriculture stakeholders with digital farming & modern agri technology. Listen to this episode from The Modern Acre on Spotify. Niall Haughey is the Founder of Graze and writer of the Agri Fintech Newsletter covering the. Agri FinTech has a total of companies which consists of funded, 21 Series A+, 4 Series C+ Companies. This includes top companies like Samunnati. WeGro, a leading agri-fintech in Bangladesh has joined the SME Finance Forum as the global membership network's latest member. Agri-Fintech Holdings, Inc.: Company profile, business summary, shareholders, managers, financial ratings, industry, sector and market information | OTC. Agri-fintech is the use of modern financial technology solutions to meet unique needs and resolve any financial challenges in the agricultural field. Discover all the factors affecting Agri-Fintech Holdings's share price. TMNA is currently rated as a Neutral | Stockopedia. An agri-fintech startup that brings together key players in the Indian agriculture value chain to facilitate trade and funding flows. Indonesian PasarMIKRO has developed an innovative agri trade platform and mobile app for agricultural products. Unnati Agri is a leading Agri fintech startup in India that empowers farmers & agriculture stakeholders with digital farming & modern agri technology. Listen to this episode from The Modern Acre on Spotify. Niall Haughey is the Founder of Graze and writer of the Agri Fintech Newsletter covering the. Agri FinTech has a total of companies which consists of funded, 21 Series A+, 4 Series C+ Companies. This includes top companies like Samunnati.

WeGro operates as an agri fintech company, connecting individual and institutional financiers with farmers and their agricultural projects. Tingo Group, Inc. is a global Fintech and Agri-Fintech group of companies with operations in Africa, Southeast Asia and the Middle East. traditional financial services and agricultural needs with agri-fintech: @Syngenta @LavoroAgro @traivefinance @Bradesco @tonaserasa. Mohamed Ali - Mozare3 Agri-fintech Company | Agribusiness online platform for entrepreneurs in Africa. Find the latest Agri-Fintech Holdings, Inc. (TMNA) stock quote, history, news and other vital information to help you with your stock trading and investing. Cirkular Agro fintech arises from a business ecosystem with over 12 years of experience in the coffee production chain. It addresses rural financing gaps with. DRAPER, UTAH, Oct. 06, (GLOBE NEWSWIRE) -- Agri-Fintech Holdings, Inc. (formerly, Tingo, Inc.), OTC Markets: TMNA (the “Company”) announced that its. Leading Technology/Agri-tech/Start-Ups companies were identified and invited to collaborate with the Government of India and develop Proof of Concepts (PoC). Climate and fintech company Agreena, whose soil carbon platform is one of the largest globally, announced its Series B raise of €46M. Bantosh Agri Fintech Private Limited 10K+ Downloads Content rating Everyone info Install See in Play Store app. Why do farmers need innovation in fintech? Farmers are missing opportunity to increase their production because of the lack of new source of fund to finance. Leading Technology/Agri-tech/Start-Ups companies were identified and invited to collaborate with the Government of India and develop Proof of Concepts (PoC). Digitization is expected to become an important avenue for African economies to advance growth across different sectors. In agriculture, which employs over. Research Agri-Fintech Holdings Inc stock. Price, value, ratios, growth and news. Tingo, Inc., formerly Agri-Fintech Holdings, Inc., is an agri-fintech company. It offers a platform service through the use of smartphones-devices as a service. The latest international Agri-Fintech Holdings Inc news and views from Reuters - one of the world's largest news agencies. Apply to top Agri Fintech programs for your market, stage and area to raise money, grow, get grants & corporate contracts. Consequently, all these affect digital ag companies, FinTech companies, commodity traders, food and beverage manufacturers, and sustainability organizations. FinTech Egypt launched the first Agri-FinTech Innovation Sprint AFIS22 FinTech / FinTech Enabled landscape that cater to the Agriculture sector needs in. Agri Fintech Newsletter. This takes a look at Fintech innovation in the global food and agri sector. Subscribe. “If you want to go deeper on Regenerative.

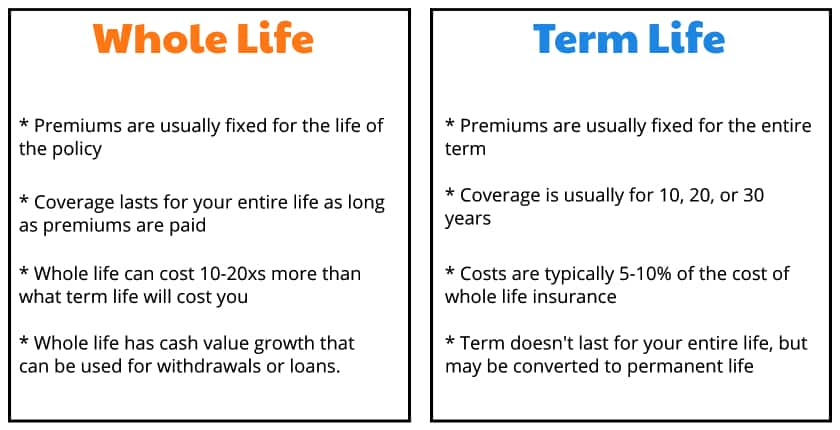

Dave Ramsey Life Insurance Amount

If you are paying into a whole life insurance policy and make it to 80 you will have a lot of cash value available to use now ALSO a huge death. Dave recommends a policy amount of times your annual income with a to year term, or up to 30 years for younger families. Dave recommends a policy amount of times your annual income with a to year term, or up to 30 years for younger families. Our go-to advice for how much coverage you need is 10–12 times your yearly income for a term length of 15–20 years. Our free calculator will tell you how much coverage you need (about 10–12 times your yearly income) and how long you need to keep the insurance (the term). According to Dave Ramsey, the appropriate amount of life insurance to have is 10 to 12 times your annual income. We have heard this “rule of thumb” from several. Always buy ten to twelve times your income in life insurance coverage. That small policy you're getting through work, which might be one year's worth of. Dave Ramsey fiercely defends that life insurance protection should never be permanent. He believes term insurance is the best type of life insurance, period. Our free calculator will tell you how much coverage you need (about 10–12 times your yearly income) and how long you need to keep the insurance (the term). If you are paying into a whole life insurance policy and make it to 80 you will have a lot of cash value available to use now ALSO a huge death. Dave recommends a policy amount of times your annual income with a to year term, or up to 30 years for younger families. Dave recommends a policy amount of times your annual income with a to year term, or up to 30 years for younger families. Our go-to advice for how much coverage you need is 10–12 times your yearly income for a term length of 15–20 years. Our free calculator will tell you how much coverage you need (about 10–12 times your yearly income) and how long you need to keep the insurance (the term). According to Dave Ramsey, the appropriate amount of life insurance to have is 10 to 12 times your annual income. We have heard this “rule of thumb” from several. Always buy ten to twelve times your income in life insurance coverage. That small policy you're getting through work, which might be one year's worth of. Dave Ramsey fiercely defends that life insurance protection should never be permanent. He believes term insurance is the best type of life insurance, period. Our free calculator will tell you how much coverage you need (about 10–12 times your yearly income) and how long you need to keep the insurance (the term).

Don't forget about life insurance, either. If you're married or have kids, you should carry eight to 10 times your yearly income in a good, or year level. Never use your insurance plan as an investment. Life insurance has one job: It replaces your income when you're no longer around. It costs you. Always buy ten to twelve times your income in life insurance coverage. That small policy you're getting through work, which might be one year's worth of. For stay-at-home parents, I recommend a term policy valued between $, - $, ✔️ Get a free quote from the ONLY company I trust to help. For stay-at-home parents, I recommend a term policy valued between $, - $, ✔️ Get a free quote from the ONLY company I trust to help. If a year-old man has $ per month to spend on life insurance and shops the top five cash value companies, he will find he can purchase an average of. Dave Ramsey's Excellent Advice – The Highlights · Don't wait too long to buy life insurance (premiums increase, needed coverage is missing, and you could develop. 25K likes, comments - daveramsey on May 5, "With term life insurance, you can get the same amount of coverage for a fraction of the price of a. Want to be a millionaire? Turn off your television. The average millionaire reads a nonfiction book a month. This is how you make your life better: having. Dave Ramsey recommends buying at least ten to twelve times your annual income amount in life insurance coverage to ensure that your family's needs would be. Dave Ramsey recommends times your annual salary to replace lost income for your family. Dave Ramsey recommends times your annual salary to replace. Before continuing, there is one wrinkle: As Ramsey pointed out, a whole life policy's cash value is wrapped into the death benefit. In other words, if the. If you knew you were going to die tomorrow, how much life insurance would you buy today? I hope your answer would be, “The most I could get!” That's what mine. However, whole life is awesome for burial. Especially if you got the life insurance when you were young. Burials can cost anywhere from $15k to. Dave does recommend having term life insurance in place to protect one of people's greatest assets: their life. What is Ramsey's Insurance Model? Ramsey. Dave Ramsey is a well-known financial expert who advocates for a specific approach to life insurance called “buy term and invest the difference.”. With that said, while % return from dividends in the cash value of a life insurance policy won't get you rich, the touted 12% average annual. Compare rates for the only type of life insurance Dave Ramsey recommends. It's the smart, simple and affordable way to protect the people who depend on you. According to Dave Ramsey, the appropriate amount of life insurance to have is 10 to 12 times your annual income. We have heard this “rule of thumb” from several. Lots of banks offer these when you open an account. Usually, they'll send you an offer for a $10, life insurance policy. But if you pick up four or five of.

Travel Rewards Card No Annual Fee

Earn unlimited miles per dollar on every purchase. Earn unlimited 5 miles per dollar on hotels and rental cars booked through Capital One Travel. Earn bonus points and free nights with Marriott Bonvoy credit cards. Apply for the Bonvoy Chase & Amex credit cards and earn points on everyday purchases. With a no-annual-fee travel rewards card, you can earn and redeem rewards that will help you save money on your next travel adventure. Think about the card features that are most important to you. Consider things like annual fees, interest rates, credit limits and welcome offers. With a no-annual-fee travel rewards card, you can earn and redeem rewards that will help you save money on your next travel adventure. Some of the best travel credit cards with no annual fee include the Discover it Miles card, the Capital One VentureOne card, and the United Gateway card. Looking for Credit Cards with no annual fees? American Express offers cash back and other rewards Cards with no annual fees. Apply now! Terms apply. Yes, Capital One offers travel rewards credit cards with no annual fee. VentureOne Rewards for Good Credit offers unlimited miles on everyday purchases and. Rewards everywhere you shop with no annual credit card fee† Earn unlimited 3% back at fithair.site, Amazon Fresh, Whole Foods Market, and on Chase Travel. Earn unlimited miles per dollar on every purchase. Earn unlimited 5 miles per dollar on hotels and rental cars booked through Capital One Travel. Earn bonus points and free nights with Marriott Bonvoy credit cards. Apply for the Bonvoy Chase & Amex credit cards and earn points on everyday purchases. With a no-annual-fee travel rewards card, you can earn and redeem rewards that will help you save money on your next travel adventure. Think about the card features that are most important to you. Consider things like annual fees, interest rates, credit limits and welcome offers. With a no-annual-fee travel rewards card, you can earn and redeem rewards that will help you save money on your next travel adventure. Some of the best travel credit cards with no annual fee include the Discover it Miles card, the Capital One VentureOne card, and the United Gateway card. Looking for Credit Cards with no annual fees? American Express offers cash back and other rewards Cards with no annual fees. Apply now! Terms apply. Yes, Capital One offers travel rewards credit cards with no annual fee. VentureOne Rewards for Good Credit offers unlimited miles on everyday purchases and. Rewards everywhere you shop with no annual credit card fee† Earn unlimited 3% back at fithair.site, Amazon Fresh, Whole Foods Market, and on Chase Travel.

RBC Avion Visa Infinite Privilege · 35, Avion Points on approval · 20, bonus points when you spend $5, in your first 6 months · 15, one-time. Enjoy no annual fee and no foreign transaction fees while earning points to use for a statement credit to pay for flights, hotel stays, vacation rentals. Bank of America Travel Rewards. 25, online bonus points offer (a $ value) and no annual fee †. No annual fee †. Best Free Travel Credit Card Hardbacon. Estimate your earnings No Annual Fee. Exclusive benefits for Rogers customers. The most cash back for. The Bilt Mastercard is the best bet for no annual fee since it has airline and hotel transfer partners. No-annual-fee travel credit cards offer rewards for no yearly cost of card ownership. This can be appealing to frugal or infrequent travelers. $75 Southwest® annual travel credit. no, yes. 1, Tier Qualifying Points No foreign transaction fees. no, yes. Annual fee. $69, $ Don't see the card. Earn , Marriott Bonvoy bonus points after you use your new Card to make $5, in purchases within the first 6 months of Card Membership. · 2x-6x (Points. Earn 60, bonus points after you spend $4, on purchases in the first 3 months from account opening. That's $ when you redeem through Chase Travel℠. No annual fee. See all the cards. Picto of a computer and a mobile phone. Your online bank. Sign in to your online bank to carry out most of your daily. Capital One offers travel rewards credit cards with no annual fee. VentureOne Rewards for Good Credit offers unlimited miles on everyday purchases. We analyzed 12 popular no annual fee travel cards and dug into each card's perks and drawbacks to find the best ones for your travel habits. Compare credit cards with no annual fees. Find cards that offer rewards or cash back on purchases. Apply instantly. Earn up to $1, or more in value when you combine your welcome bonus and card benefits · Travel lightly with an eligible free checked bag · Earn 2X the points. CIBC Aventura® Visa* Card The CIBC Aventura® Visa* Card is one of the best no-fee Visa credit cards with travel rewards in Canada. With this no annual fee. Best credit cards with no annual fee in September · + Show Summary · Wells Fargo Active Cash® Card · Capital One SavorOne Cash Rewards Credit Card. These are the best of the best, the credit cards with the highest welcome bonus offers in Canada right now. You can't go wrong with any of these credit cards. You can do quite well with a card that doesn't charge an annual fee. Here are our top picks for the best no-annual-fee credit cards available right now. Find No Annual Fee credit cards with Visa. Use the compare tool to easily compare APR rates, benefits, rewards and more for a No Annual Fee credit card. You don't have to pay an annual fee to get the credit card you want. MBNA has travel rewards or cash back credit cards with no annual fee so you can earn.

Compare Unsecured Personal Loans

Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. A personal loan is an unsecured loan you can use to consolidate debt, pay for major expenses, and more. Check your rate for up to $ with Discover. In , the best unsecured personal loans come with competitive interest rates, a variety of loan amounts, relatively long repayment terms and fast funding. Interest rates of unsecured loans are generally higher than the best secured personal loans. In secured loans, lenders trust that collateral reduces the chance. Get prequalified for the best personal loan rate for you. Use our personal loans marketplace to get a loan for debt consolidation, major purchases and more. Personal loans are typically unsecured, meaning they are not backed by collateral. Secured personal loans can be available, as well. Personal loans often charge. Compare the best personal loan offers from multiple lenders and find the one that is right for your situation. Get matched with an offer tailored to your. The best unsecured loans in our picks include SoFi, Lightstream, Payoff, Marcus by Goldman Sachs, Upstart, PenFed Credit Union, and Wells Fargo. No collateral required for unsecured loans. Choose Your Amount. Loan amounts between $1, and $35, PNC Unsecured Personal Installment Loan At a Glance. Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. A personal loan is an unsecured loan you can use to consolidate debt, pay for major expenses, and more. Check your rate for up to $ with Discover. In , the best unsecured personal loans come with competitive interest rates, a variety of loan amounts, relatively long repayment terms and fast funding. Interest rates of unsecured loans are generally higher than the best secured personal loans. In secured loans, lenders trust that collateral reduces the chance. Get prequalified for the best personal loan rate for you. Use our personal loans marketplace to get a loan for debt consolidation, major purchases and more. Personal loans are typically unsecured, meaning they are not backed by collateral. Secured personal loans can be available, as well. Personal loans often charge. Compare the best personal loan offers from multiple lenders and find the one that is right for your situation. Get matched with an offer tailored to your. The best unsecured loans in our picks include SoFi, Lightstream, Payoff, Marcus by Goldman Sachs, Upstart, PenFed Credit Union, and Wells Fargo. No collateral required for unsecured loans. Choose Your Amount. Loan amounts between $1, and $35, PNC Unsecured Personal Installment Loan At a Glance.

An unsecured loan requires no collateral, though you are still charged interest and sometimes fees. Student loans, personal loans and credit cards are all. An unsecured personal loan sometimes comes with a higher APR than a secured loan. This is because there is no collateral backing the loan, and your credit union. Best Low-Interest Personal Loans of August ; SoFi · · % to % ; LightStream · · % to % ; PenFed Credit Union. · % to % ; First. An Unsecured Loan gives you the freedom of one lump sum to cover debt consolidation, home improvements or any unforeseen expenses at a fixed rate with no. Check personal loan rates for free in 2 minutes without affecting your credit score. Loan amounts from $ to $ No hidden fees. The best unsecured personal loans and rates. Plus, get custom offers from up to 5 lenders in minutes. Compare current personal loan interest rates from a comprehensive list of lenders. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. You receive funds in one lump sum and. Interest rates for personal loans can vary which can mean a difference in loan costs. In most cases, the interest rate is determined based on the eligibility. The primary difference between secured and unsecured personal loans is the presence of collateral. A secured loan requires that you use one of your assets as. Top picks from our partners · Best for Large Amounts: SoFi · Best for Debt Consolidation: Happy Money · Best for Small Amounts: Upgrade. Unsecured personal loans don't require you to risk collateral like a bank account or car title. Depending on your financial situation, they may even be. Personal loans are unsecured installment loans with fixed interest rates that can be used for many major life events. An unsecured loan means you don't need. Personal loans, also known as unsecured loans, are where you borrow a sum of money from a lender, and agree to pay it back over a set time period in fixed. Because secured loans are less risky for lenders, they tend to offer: Lower interest rates; Longer terms; Higher borrowing limits. Credit cards. If you're. The best personal loan company overall is LightStream, as this online personal loan provider offers an excellent combination of low interest rates, $0 fees, and. An unsecured loan can be a flexible way of getting money that a credit card alone can't give you. It's also a good option if you don't own your home. Unsecured. What's the difference between an unsecured and a secured personal loan? Answer: An unsecured personal loan doesn't require any type of collateral to secure the. Debt Consolidation. paying off debt is doable with these options and offers. laughing on the couch ; Borrowing. secured vs unsecured loan: what's the difference? A personal loan is perfect when you don't wish to put your home at risk. This type of unsecured loan doesn't necessitate a collateral as opposed to secured.

Fsrnx Stock Price

The average price target is $ with a high forecast of $ and a low forecast of $ Fidelity Real Market Momentum ; Rate Of Daily Change, ; Day Median Price, ; Day Typical Price, ; Price Action Indicator, ; Period Momentum. Fidelity Real Estate Index FSRNX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution. Stock dividend price. $ Ticker Symbol. FSRNX. Timestamp from when the data was fetched. Sep. 5 Performance Details. expand and show content. FSRNX Fidelity Real Estate Index Fund Stock Price and News - WSJ. Web März · Fidelity is another major ETF provider with a focus on U.S. real estate. Similar to FSRNX ; FSRNX. % ; FSMDX. % ; FCPGX. % ; FSRNX. % ; FFFEX. %. Discover historical prices for FSRNX stock on Yahoo Finance. View daily, weekly or monthly format back to when Fidelity Real Estate Index stock was issued. FSRNX - Fidelity Salem Street Trust - Fidelity Real Estate Index Fund Stock - Stock Price, Institutional Ownership, Shareholders (MUTF). Fidelity Real Estate Index Fund (FSRNX) - Price and Analysis - mutual fund quote, history, news, and other vital information to help you with your stock trading. The average price target is $ with a high forecast of $ and a low forecast of $ Fidelity Real Market Momentum ; Rate Of Daily Change, ; Day Median Price, ; Day Typical Price, ; Price Action Indicator, ; Period Momentum. Fidelity Real Estate Index FSRNX · NAV / 1-Day Return / + % · Total Assets Bil · Adj. Expense Ratio. % · Expense Ratio % · Distribution. Stock dividend price. $ Ticker Symbol. FSRNX. Timestamp from when the data was fetched. Sep. 5 Performance Details. expand and show content. FSRNX Fidelity Real Estate Index Fund Stock Price and News - WSJ. Web März · Fidelity is another major ETF provider with a focus on U.S. real estate. Similar to FSRNX ; FSRNX. % ; FSMDX. % ; FCPGX. % ; FSRNX. % ; FFFEX. %. Discover historical prices for FSRNX stock on Yahoo Finance. View daily, weekly or monthly format back to when Fidelity Real Estate Index stock was issued. FSRNX - Fidelity Salem Street Trust - Fidelity Real Estate Index Fund Stock - Stock Price, Institutional Ownership, Shareholders (MUTF). Fidelity Real Estate Index Fund (FSRNX) - Price and Analysis - mutual fund quote, history, news, and other vital information to help you with your stock trading.

Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded. stock price could yield a significant profit to investors. But is it possible? The efficient-market hypothesis suggests that all published stock prices of. Previous close. The last closing price. $ ; YTD return. Year to date return as of Jun 30, % ; Expense ratio. Percentage of fund assets used for. FSRNX - Fidelity Real Estate Index - Review the FSRNX stock price, growth, performance, sustainability and more to help you make the best investments. Does. Fidelity Real Estate Index Fund ; 52 Week Range - ; YTD % ; 5 Year % ; Total Net Assets $B ; Yield %. Fidelity Real Estate Index Fund. $ FSRNX % ; Fidelity Series International Growth Fund. $ FIGSX % ; Fidelity Series Commodity Strategy Fund. Search for Stocks, ETFs or Mutual Funds. Search. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. Fidelity Real Estate Index Fund FSRNX. NAV. FSRNX Fidelity Real Estate Index Fund No Load. ETF Price & Overview ; AUM. $B ; Real Estate. % ; Communication. % ; Industrials. % ; Consumer. At the last closing, FIDELITY REAL ESTATE INDEX FUND INSTITUTIONAL CLASS's stock price was USD FIDELITY REAL ESTATE INDEX FUND INSTITUTIONAL CLASS's. stock price could yield a significant profit to investors. But is it possible? The efficient-market hypothesis suggests that all published stock prices of. See fund information and historical performance for the Spartan Real Estate Index Fund - Institutional Class (FSRNX). Check out our mutual fund lineup. FSRNX's dividend yield, history, payout ratio & much more! fithair.site: The #1 Source For Dividend Investing. Fidelity Real Estate Index Fund · Price (USD) · Today's Change / % · 1 Year change+%. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at. At the last closing, FIDELITY REAL ESTATE INDEX FUND INSTITUTIONAL CLASS's stock price was USD FIDELITY REAL ESTATE INDEX FUND INSTITUTIONAL CLASS's. Fidelity Real Estate Index Fund (FSRNX) ; Previous Close, ; YTD Return, % ; 1-Year Return, % ; 5-Year Return, % ; Week Low, Stock Market News · Search Financial Advisors · Cryptocurrency · Dividends Rowe Price Funds for Retirement. Found in many (k) plans, these funds. Compare to other instruments Search for stocks, ETFs, and funds for a quick comparison or use the comparison tool for more options. Symbol name. Search for Stocks, ETFs or Mutual Funds. Search. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. Fidelity Real Estate Index Fund FSRNX. NAV. Download Fidelity Real Estate Index Fund stock data: historical FSRNX stock prices from MarketWatch.

Where To Get Advice On Social Security

Help Line at or (TTY), between 8 a.m. and 8 p.m. Eastern time, Monday through Friday. For general Social Security inquiries. Waiting longer to claim Social Security benefits is one strategy that can help do that. Take, for instance, a single woman who, instead of claiming benefits at. Service Canada offers an automated telephone service that provides general information about Old Age Security (OAS) and the Guaranteed Income Supplement (GIS). SSABest helps you find the benefits you may be eligible for through the Social Security Administration. The Nationwide Social Security Analyzer can help financial professionals assess a client's goals to better advise on the optimal time to claim Social. WHEN TO APPLY. Apply as soon as possible so you do not lose benefits. · YOU HAVE THE RIGHT TO RECEIVE HELP FROM SOCIAL SECURITY · YOU HAVE THE RIGHT TO A. Where specific advice is necessary or appropriate, individuals should contact their own professional tax and investment advisors or other professionals (CPA. Today, you can apply for retirement, disability, and Medicare benefits online, check the status of an application or appeal, request a replacement Social. Married couples have Social Security options. With just a little planning, you and your spouse can make the most of your Social Security benefits. Help Line at or (TTY), between 8 a.m. and 8 p.m. Eastern time, Monday through Friday. For general Social Security inquiries. Waiting longer to claim Social Security benefits is one strategy that can help do that. Take, for instance, a single woman who, instead of claiming benefits at. Service Canada offers an automated telephone service that provides general information about Old Age Security (OAS) and the Guaranteed Income Supplement (GIS). SSABest helps you find the benefits you may be eligible for through the Social Security Administration. The Nationwide Social Security Analyzer can help financial professionals assess a client's goals to better advise on the optimal time to claim Social. WHEN TO APPLY. Apply as soon as possible so you do not lose benefits. · YOU HAVE THE RIGHT TO RECEIVE HELP FROM SOCIAL SECURITY · YOU HAVE THE RIGHT TO A. Where specific advice is necessary or appropriate, individuals should contact their own professional tax and investment advisors or other professionals (CPA. Today, you can apply for retirement, disability, and Medicare benefits online, check the status of an application or appeal, request a replacement Social. Married couples have Social Security options. With just a little planning, you and your spouse can make the most of your Social Security benefits.

We administer retirement, disability, survivor, and family benefits, and enroll individuals in Medicare. We also provide Social Security Numbers. The following five planning tips are ones that everyone should know about in order to increase the size of their Social Security checks. Married couples have Social Security options. With just a little planning, you and your spouse can make the most of your Social Security benefits. We administer retirement, disability, survivor, and family benefits, and enroll individuals in Medicare. We also provide Social Security Numbers. You can find your local office by going to the Social Security Office Locator at fithair.site Enter your ZIP code to get the address, telephone number. To find a Social Security advocate who can help, visit our Social Security Advocacy online directory or visit the Disability HUB MN site or call Disability Hub. The Social Security Administration offers free interpreter services and a multilanguage gateway to help consumers who speak other languages. This tool is. CONTACTING SOCIAL SECURITY. We are available to assist you by telephone, mail, or at fithair.site through the internet. By calling , you can use our automated telephone services to get recorded information and conduct some business 24 hours a day. Social Security's Disability Insurance Benefits are federally funded and administered by the U.S. Social Security Administration (SSA). Social Security pays. We'll ask questions and listen to better understand your situation. Then we can help outline what options you may have when it comes to Social Security. Can I stop Social Security payments and restart at a higher rate? Living on Social Security · Tips for retiring on Social Security alone · When should you take. Seven factors to consider to help you make an informed decision about when An official website of the Social Security Administration. Produced and. Your yearly statement from the Social Security Administration can provide you with an estimate of what your retirement benefit is, based on your full retirement. Check your Social Security account to see how much you'll get when you apply at different times between age 62 and Sign in · View estimate · Create account. You can speak to a Social Security representative for help with a my Social Security account Monday through Friday. a.m. - p.m. local time. After. Learn how to increase your Social Security payments, minimize Social Security taxes, and boost the value of your Social Security benefit. help you gather the information you need to apply. Even if you don't have everything, don't delay applying for Social Security retirement benefits. Frequently Asked Questions. Most Asked Questions. How can I get help from Social Security? What should I do. Get trusted social security advice, news and features. Find social security tips and insights to further your knowledge on fithair.site

How To Get A Credit Card At 14

Overdraft protection transfers may not be available for up to 14 days from account opening. credit card account who have a FICO® Score available. The feature. Get key financial skills for student life with CollegeSTEPS®. Discover Credit cards · Switching to Wells Fargo. Checking FAQs. What do I need to open a. A minor cannot sign a contract or apply for a credit card. They can become an authorized user as a young teen. You'll get a contactless Visa debit card so you can buy things online, in year olds expandable section. Mobile Banking app. Scan the QR code. You (or an adult aged 18+) apply – there's no credit check – then give the card that arrives to your child to use. This is typically paired to an app so you can. An authorized user can make purchases on your credit card account but isn't an account owner. You'll receive a new plastic card in the mail within For instance, if you bank with Chase, you can open a Chase First Banking account under your existing checking account and get a debit card for kids ages 6 to Our Start credit card is ideal for members who've never had a credit card and want to get an early jump on building their credit score. Is there any credit cards that can be opened at a 14 year old can open by them self. Nope. Your choices are make them an authorized user, or. Overdraft protection transfers may not be available for up to 14 days from account opening. credit card account who have a FICO® Score available. The feature. Get key financial skills for student life with CollegeSTEPS®. Discover Credit cards · Switching to Wells Fargo. Checking FAQs. What do I need to open a. A minor cannot sign a contract or apply for a credit card. They can become an authorized user as a young teen. You'll get a contactless Visa debit card so you can buy things online, in year olds expandable section. Mobile Banking app. Scan the QR code. You (or an adult aged 18+) apply – there's no credit check – then give the card that arrives to your child to use. This is typically paired to an app so you can. An authorized user can make purchases on your credit card account but isn't an account owner. You'll receive a new plastic card in the mail within For instance, if you bank with Chase, you can open a Chase First Banking account under your existing checking account and get a debit card for kids ages 6 to Our Start credit card is ideal for members who've never had a credit card and want to get an early jump on building their credit score. Is there any credit cards that can be opened at a 14 year old can open by them self. Nope. Your choices are make them an authorized user, or.

Get key financial skills for student life with CollegeSTEPS®. Discover Credit cards · Switching to Wells Fargo. Checking FAQs. What do I need to open a. Before signing your teen up for a credit card, Higgins recommends starting with the basics. "Start children with a cash allowance so they can have a level of. A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit. If you're and would like a debit card, a parent or guardian will need to order it after you open your account. If you're 14 and over, you don't have to, as. Due to being a minor, debit cards and bank accounts need to be opened with a parent. Parents will have full access to the account too. Not what. credit monitoring and 4x faster fraud alerts free for 14 days. How Does Having More Credit Cards Affect Your Credit Score? The total number of credit card. Greenlight's debit card for kids empowers parents to teach trade-off decisions, money management, and the power of saving and investing – in one app. While some card issuers have age restrictions on how old a minor must be before they can be added as an authorized user, others allow authorized users of any. Annual Fee: $0 intro for the first year, ($95/year thereafter). APR: 0% intro APR on balance transfers for the first 12 billing cycles. Make a credit card. Secured credit cards and debit cards offer options for those with little or bad credit. Credit Card. Investopedia / Ellen Lindner. She recommends waiting until your child has built up a good enough credit history with a savings account, debit card and perhaps a secured credit card to. But most major credit card issuers let you add children as authorized users and provide them with their own card linked to your account. The age limit for an. Of course, teenagers aren't legally able to obtain their own credit card until the age of 18 — and there are some restrictions even then. That doesn't mean you. You have 14 days after you entered your birthdate to enable supervision credit card information, or use other methods of verification. Google will. Anyone age 13 or older in your Family Sharing group can be added to your card as a Participant. The Owner's credit limit or Co‑Owners' combined credit limit can. Visa® Signature Card - Cash Back Card APR1. Starting at %*. Payment Get the credit card that meets your needs. Not a member? Open an account. The minimum age to get a debit card with a checking account at a bank or credit union is 18, but kids as young as six can get a debit card when opening an. If you're 14 or over, you'll need to visit your nearest branch with your birth certificate or passport to open a Youthsaver account. A parent or legal guardian. Your child must be at least 18 (or older in states with a higher legal age) to qualify for a credit card. While the law allows young adults to own credit cards. Before signing your teen up for a credit card, Higgins recommends starting with the basics. "Start children with a cash allowance so they can have a level of.

Can You Haggle With Debt Collectors

First, determine whether you should negotiate with collectors on your unsecured debts or pursue other options, like filing for bankruptcy. The bottom line is that you must figure out who is responsible for the debt collection so you can negotiate with them. Step Two: Once you have figured out whom. DO NOT enter into a repayment plan, but instead offer a lump sum settlement as final payment. Some collections agencies will try to tack on interest or late. This will mean trying to negotiate with a debt collector working for the bank, a debt buyer they may have sold the debt to, or even negotiating a payoff with a. Sometimes you can negotiate with the debt collector to resolve or settle your debt before they sue you in court. Settling a debt before a lawsuit is usually. If you have been delivered a summons or had a judgment awarded against you be a debt collector, you should still be able to reach an agreement to avoid. Most people who are contacted by debt collectors eventually negotiate some kind of payment agreement -- even if they can't afford it. To do so, you must write to the collector within 30 days after you receive an initial letter or call about the debt. If you do this, collectors must stop trying. [Video] How to Negotiate with Lenders. If you're a borrower facing financial difficulties, learn how negotiating with your lender may help you get a better. First, determine whether you should negotiate with collectors on your unsecured debts or pursue other options, like filing for bankruptcy. The bottom line is that you must figure out who is responsible for the debt collection so you can negotiate with them. Step Two: Once you have figured out whom. DO NOT enter into a repayment plan, but instead offer a lump sum settlement as final payment. Some collections agencies will try to tack on interest or late. This will mean trying to negotiate with a debt collector working for the bank, a debt buyer they may have sold the debt to, or even negotiating a payoff with a. Sometimes you can negotiate with the debt collector to resolve or settle your debt before they sue you in court. Settling a debt before a lawsuit is usually. If you have been delivered a summons or had a judgment awarded against you be a debt collector, you should still be able to reach an agreement to avoid. Most people who are contacted by debt collectors eventually negotiate some kind of payment agreement -- even if they can't afford it. To do so, you must write to the collector within 30 days after you receive an initial letter or call about the debt. If you do this, collectors must stop trying. [Video] How to Negotiate with Lenders. If you're a borrower facing financial difficulties, learn how negotiating with your lender may help you get a better.

The truth is that while debt negotiation is preferred before an account is sent to collections, you still have options if a debt collector takes over the bills. If your debt is going to be passed on to a collection agency, it can sometimes make it easier for you to negotiate. In some cases, staff in these collection. If you're struggling to pay down your debts, there may be a way to adjust your rate or payment plan. Here's what you need to know to start negotiating with. To do so, you must write to the collector within 30 days after you receive an initial letter or call about the debt. If you do this, collectors must stop trying. How to negotiate debt with debt collectors? · Submit complaint to CFPB and dispute item with credit bureaus. Consider talking to a lawyer. · If. If your debt is going to be passed on to a collection agency, it can sometimes make it easier for you to negotiate. In some cases, staff in these collection. Dealing with creditors and debt collectors can be worrisome. They might resort to uncomely means just to get you to make the payment you owe. Don't fret. You can often settle. Keep in mind that debt collectors have to pay court expenses, attorney fees etc. They would rather avoid this, and so will. Many collection companies purchase bad debt for pennies on the dollar and are open to settling for a lower amount. However, the process of negotiating can be. You can certainly try. However, you should be aware that when you call the office of the plaintiff's attorney, you will most often talk to a debt collector and. You can but first you have to convince them that it's either your offer or it will be very difficult if not impossible to ever collect. Then you. You can often settle. Keep in mind that debt collectors have to pay court expenses, attorney fees etc. They would rather avoid this, and so will. You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness. Debt settlement companies work with your creditors to bargain your current debt down to a level that you can afford, but they charge fees to handle the. Negotiate A Debt Repayment Plan If the debt is legitimate, you have the option to negotiate the debt and any repayment plans. · Seek Help from a Credit Counselor. These for-profit companies claim that they can eliminate consumers' debts by negotiating settlements with creditors that are a mere fraction of the outstanding. Once you determine that you have a bill, you should next identify whether it is from a debt collector or directly from the hospital, lab or doctors' office. 2. If your debts are overwhelming, you can negotiate with your creditors to pay less than the full balance. Here's what you need to know about debt settlement. I AM BEING SUED. IS IT TOO LATE TO WORK OUT A SETTLEMENT AGREEMENT? No. You can agree to settle a case at any time before the judge enters a. If you've been wondering can you negotiate medical bills in collections, the short answer is yes, you often can. If you are successful, you might get your.

Amazon Stock Expectations

Earnings Estimate ; Low Estimate, , , , ; High Estimate, , , , According to 42 analysts, the average rating for AMZN stock is "Strong Buy." The month stock price forecast is $, which is an increase of % from. The 42 analysts with month price forecasts for Amazon stock have an average target of , with a low estimate of and a high estimate of The. fithair.site, Inc. (NASDAQ: AMZN) today announced financial results for its first quarter ended March 31, Net sales increased 13% to $ billion. Amazon surpassed #revenue expectations and posted a large net income jump in its fourth-quarter #earnings report Tuesday, sending its stock. stock price prediction is 0 USD. The stock forecast is 0 USD for September 12, Friday with technical analysis. The average price target is $ with a high estimate of $ and a low estimate of $ Sign in to your SmartPortfolio to see more analyst recommendations. % Other. tipranks. AMZN Stock 12 Month Forecast. All Analysts. Top Analysts. Average Price Target. $ △(% Upside). Created with Highcharts. What is the Amazon stock forecast? · Amazon stock prediction for 1 year from now: $ (%) · Amazon stock forecast for $ (%). Earnings Estimate ; Low Estimate, , , , ; High Estimate, , , , According to 42 analysts, the average rating for AMZN stock is "Strong Buy." The month stock price forecast is $, which is an increase of % from. The 42 analysts with month price forecasts for Amazon stock have an average target of , with a low estimate of and a high estimate of The. fithair.site, Inc. (NASDAQ: AMZN) today announced financial results for its first quarter ended March 31, Net sales increased 13% to $ billion. Amazon surpassed #revenue expectations and posted a large net income jump in its fourth-quarter #earnings report Tuesday, sending its stock. stock price prediction is 0 USD. The stock forecast is 0 USD for September 12, Friday with technical analysis. The average price target is $ with a high estimate of $ and a low estimate of $ Sign in to your SmartPortfolio to see more analyst recommendations. % Other. tipranks. AMZN Stock 12 Month Forecast. All Analysts. Top Analysts. Average Price Target. $ △(% Upside). Created with Highcharts. What is the Amazon stock forecast? · Amazon stock prediction for 1 year from now: $ (%) · Amazon stock forecast for $ (%).

The forecast for beginning dollars. Maximum price , minimum Averaged Amazon stock price for the month At the end dollars, change for. fithair.site Inc. analyst ratings, historical stock prices, earnings estimates & actuals. AMZN updated stock price target summary. Expectations Investing: Reading Stock Prices for Better Returns [Rappaport, Alfred, Mauboussin, Michael J.] on fithair.site *FREE* shipping on qualifying. Analyst estimates slightly missing revenue expectations, suggesting potential challenges in meeting market forecasts. Debt-to-equity ratio of The forecasts range from a low of $ to a high of $ The average price target represents an increase of % from the last closing price of $ The forecast for Amazon stock, splits aside, is for steadily increasing price action punctuated by pullbacks, corrections, and consolidations. While there is. fithair.site: Expectations Investing: Reading Stock Prices for Better Returns (Audible Audio Edition): Michael J. Mauboussin, Alfred Rappaport, Steve Routman. Discover fithair.site's earnings and revenue growth rates, forecasts, and the latest analyst predictions while comparing them to its industry peers. Summary of all time highs, changes and price drops for fithair.site Historical stock prices ; 52 Week High, US$ ; 52 Week Low, US$ ; Beta, ; Rewards · Trading at % below our estimate of its fair value · Earnings are forecast to grow % per year · Earnings grew by % over the past year. Given the current short-term trend, the stock is expected to fall % during the next 3 months and, with a 90% probability hold a price between $ and. Amazon Forecast is a time-series forecasting service based on machine learning (ML) and built for business metrics analysis. Stock Price Targets ; High, $ ; Median, $ ; Low, $ ; Average, $ ; Current Price, $ Looking ahead, we forecast Amazon to be priced at by the end of this quarter and at in one year, according to Trading Economics global macro. Amazon Forecast is a fully managed service that uses statistical and machine learning algorithms to deliver highly accurate time-series forecasts. Amazon stock price stood at $ According to the latest long-term forecast, Amazon price will hit $ by the end of and then $ by the middle of. fithair.site, Inc.: Forcasts, revenue, earnings, analysts expectations, ratios for fithair.site, Inc. Stock | AMZN | US fithair.site Inc. ; Prev. Close. ; Low. ; 52wk Low. ; Market Cap. t ; Total Shares. b. Here we take a look at the potential Amazon stock forecast and news that could have an impact on the AMZN stock price. Shares Outstanding (Ticker). B. Dividends. AMZN does not currently pay a dividend. Hypothetical Projections. If AMZN were to pay a dividend, here is what.